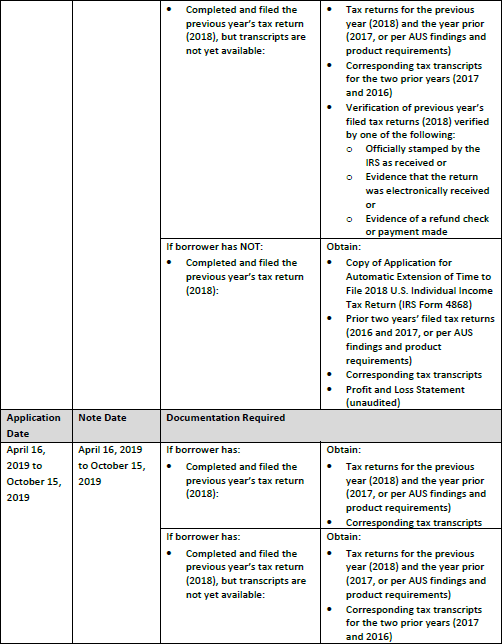

Since late filing penalties are higher than late payment penalties, you should file a return or renewal, even if you can`t afford to pay your taxes on time. April 2021 for the 2020 tax year for unpaid taxes. Late payment penalties apply after the expiry of the tax day deadline of September 15. Important: The only way to avoid late filing penalties is to file or file an income tax return or extension electronically before the tax date – Apfor the 2020 taxation year – and, in the case of a tax extension, file the tax return electronically by October 15, 2021. When you complete your return, you must indicate the amount you have already paid in the payment section of your Form 1040. From there, you need to determine the approximate amount due, if any.Īfter submitting the extension, you have until October 15 to collect your documents and complete your submission. You will also be asked about the sum of all payments made during the taxation year through federal withholdings and estimated payments. Form 4868 asks you to estimate your entire tax liability. Anything that remains unpaid after the due date is subject to late fees and penalties, so pay what you think you owe on that date, even if you file your tax return later. Keep in mind that just because you received a return extension doesn`t mean you`ll get an extension to pay the tax you owe. We`ve answered some of the most common questions. Now that you`ve filed an extension, you may be wondering what you need to do between now and the due date of your tax return.

#2016 tax extension 4868 pro

Pro Tip: If you file your renewal using the software you already use to prepare your tax return, all your tax data will be stored in one place.

These programs will file Form 4868 electronically for you. You will probably find a link on the website if you are using a web application. Most reputable control software applications offer this feature, and they offer the option to do so on the first screen you see when you log in. You should also be able to use tax software to request an extension. This way, you won`t have to submit a separate extension form and get a confirmation number for your records. You can also obtain an extension by paying all or part of your estimated income tax and indicating that the payment of an extension is made using the direct payment, the federal electronic tax payment system (TVET), or a credit or debit card. Depending on your situation, you may be eligible for an IRS payment plan.

#2016 tax extension 4868 full

You must file your tax return before the due date, whether or not a full payment can be made with the tax return.

#2016 tax extension 4868 free

You can estimate your tax liability (or tax refund) using the free tax calculator. However, you`ll need to determine how much you`ll likely have to pay in taxes and file the payment (for at least 90% of your outstanding balance) by Apto avoid IRS penalties and interest.

If you don`t have enough tax information or all your tax records to start and file one tax return per tax day – in 2021, it`s Ap– you should file an IRS extension before that date. Extension of the deadlines for the state tax return. After that date, the IRS will no longer accept renewal applications for that tax year or tax arrears.įor example, after July 15, 2020, you will no longer be able to file an extension of your 2020 tax return or file an electronic file. Submit an extension by Jand have until Octoto complete your taxes Tax extensions are due on tax day for the current tax year. Easily complete your IRS tax extension from a brand you trust Individual taxpayers, regardless of income, can use Free File to electronically request an automatic renewal of the tax return. Even if you file an extension on time, you`ll still face default IRS penalties if you don`t pay your taxes on time. Only submit a tax extension if you don`t have all the information you need to prepare a tax return. An extension only gives you more time to do the paperwork, not more time to pay. This question draws attention to an important difference between what a tax extension is – and what is not. Form 4868 is for individual taxpayers, not corporations or other businesses that need to file returns other than a Form 1040. When some taxpayers ask, “How do I get an extension of my taxes?” they may think of the taxes owing, not the return itself. If you did not file a tax return for a previous tax year, we recommend that you file the tax return as soon as possible and pay as much as possible.

0 kommentar(er)

0 kommentar(er)